英国金融时报:海南自贸港“火了”!全球奢侈品销售重心正逐渐向中国倾斜

西方品牌押注中国消费者在疫情过后仍将在国内消费。

Western brandsbet on Chinese shoppers staying at home beyond the Covid-19 pandemic.

海南海滩上的游客。海南这座热带岛屿被称为中国的夏威夷,如今这里是免税购物中心

©Roman Pilipey/EPA-EFE 爱德华·怀特和利拉·阿布德2021年4月16日于首尔和巴黎报道

在中国古代,当诗人、文人和大臣们失宠于中国皇帝时,就会被流放到海南岛,任其在有着土著部落的原始丛林中自生自灭。

When poets,literati and courtiers fell out of favour with China’s emperors, they werebanished to the island of Hainan to fend for themselves among wild jungles andindigenous tribes.

如今,这个被称为中国夏威夷的热带度假胜地,已成为遭受新冠病毒大流行重创的全球奢侈品市场中少有的亮点。

Today, thetropical resort destination known as China’s Hawaii has become a rare brightspot in the global luxury market, which has been hit hard by the coronaviruspandemic.

“海南岛火了。”旗下拥有MichaelKors和范思哲(Versace)品牌的CapriHoldings负责人约翰·D·伊多尔(John D Idol)今年2月对分析师表示。

“Hainan Islandis on fire,” John D Idol, who heads Capri Holdings, owner of the Michael Korsand Versace brands, told analysts in February.

为了刺激国内消费,中国政府已将海南岛变成了一个免税购物中心。游客可以尽情享受古驰(Gucci)和普拉达(Prada)的时装、卡地亚(Cartier)的珠宝、雅诗兰黛(ESTĒE LAUDER)的美容产品或麦卡伦(Macallan)的高档威士忌。

To boostdomestic consumption, the Chinese government has turned the island into aduty-free shopping hub. Visitors can indulge in fashion from Gucci and Prada,jewellery from Cartier, beauty products from Estée Lauder or premium whiskyfrom The Macallan.

由于新冠疫情带来的旅游限制措施,近年来推动奢侈品行业增长的中国购物者不再能够前往巴黎、伦敦、米兰或香港购物,这也使得海南的人气变得更加火爆。

Hainan becameeven more popular when Covid-19 travel restrictions meant Chinese consumers,who have driven luxury sector growth in recent years, could no longer go onshopping trips to Paris, London, Milan or Hong Kong.

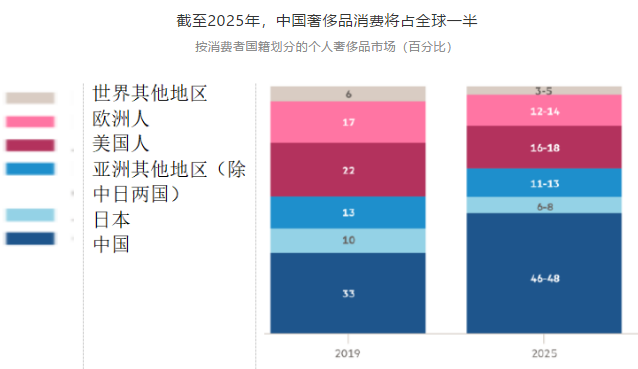

资料来源:咨询公司贝恩(Bain)

海南岛是奢侈品重心向中国倾斜的有力象征,这很像几十年前日本购物者的"回流"趋势。他们过去也在国外购买路易威登(Louis Vuitton)和巴黎世家(Balenciaga)的产品,而现在则在国内购买。

The island is apowerful symbol of how luxury’s centre of gravity is tilting towards China,mirroring the “repatriation” trend in earlier decades of Japanese shoppers whoused to buy Louis Vuitton and Balenciaga abroad but now do so at home.

这一点在行业领头羊路易威登集团(LVMH)身上体现得尤为明显。该公司的加速复苏在很大程度上由中国推动。路易威登周二表示,其今年第一季度在亚洲(不包括日本)的销售额比2019年疫情爆发前的同期高出26%。

Nowhere is thisclearer than at sector leader LVMH, whose accelerating recovery has beenfuelled in large part by China. The company said on Tuesday that itsfirst-quarter sales in Asia excluding Japan were 26 per cent higher than in thecorresponding period of 2019, before the pandemic.

分析师们预计,即使中国购物者可以再次旅行,他们也会继续在国内购物。这是因为各大品牌争相开设实体店,并扩大电子商务业务,比如阿里巴巴旗下天猫奢侈品商城的线上商店。

Even whenChinese shoppers can travel again, analysts expect they will continue to buy athome as brands open bricks-and-mortar stores and expand ecommerce offerings,such as virtual stores on Alibaba’s Tmall Luxury Pavilion.

根据咨询公司贝恩(Bain)的数据,中国消费者在国内购买高端产品的比例从2019年的32%飙升至2020年的70%以上。一旦疫情的影响消退,预计到2025年,这一数字将达到55%左右。

The share ofChinese consumers’ high-end purchases within the country soared from 32 percent in 2019 to more than 70 per cent in 2020, according to consultancy Bain,and is expected to be about 55 per cent by 2025 once the pandemic effect fades.

今年三十岁的Amy Dai是这些奢侈品品牌所吸引的典型消费者之一。她居住在重庆,过去曾前往欧洲购买奢侈品,是中国每年1.7亿海外游客中的一员。在疫情爆发前,中国游客的支出占全球奢侈品销售总额的三分之一以上。

Amy Dai isemblematic of the consumer those brands have been able to attract. The30-yearold resident of Chongqing used to make pilgrimages to Europe to buyluxury goods, one of China’s 170m annual overseas travellers whose spendingaccounted for more than a third of all global luxury sales before the pandemicstruck.

但去年,戴女士坐了两个小时的飞机到海南三亚购物,并通过网络平台购物。去年,她在购买奢侈品上花费了100多万元人民币(约15万美元),比2019年还多。

But last year,Dai took a two-hour flight to the Hainan city of Sanya to shop, and to do soturned to online platforms. Her spending on luxury items topped Rmb1m($150,000) last year, more than in 2019.

“在疫情爆发之前,我确实更喜欢出国购物,或偶尔通过海外代购渠道购买产品,”她表示,“疫情爆发后,我就开始在国内零售商那里购买了,这样我才能在第一时间买到最新的产品。”

“Before thepandemic, I did prefer going abroad or occasionally I would buy from overseaspurchasing agents,” she said. “Since the pandemic started I’ve switched todomestic retailers, because otherwise I can’t get the latest editions in time.”

根据贝恩的数据,去年全球奢侈品销售额为2170亿欧元,下降了约五分之一。在经历了艰难的2020年后,奢侈品行业正指望中国消费者推动复苏。

The luxurysector is counting on Chinese consumers to fuel the recovery after a difficult2020 in which sales contracted by roughly a fifth to €217bn globally, accordingto Bain.

中国相对成功地遏制了疫情,经济迅速复苏——去年第四季度,中国国内生产总值(GDP)增长已经恢复到疫情爆发前的水平——这对于维持针对全球经济增长的乐观情绪发挥了关键作用。

China’scomparatively successful suppression of the virus and rapid economic recovery —gross domestic product growth returned to pre-pandemic levels in the fourthquarter — played a pivotal role in maintaining optimism.

复苏最初是由“报复性购物”促成的,或者说是在世界上人口最多的国家摆脱全国封锁后的放纵,但之后出现了更为持久的复苏动力。

The recovery wasinitially spurred by “revenge shopping”, or indulging after the world’s mostpopulous country emerged from a nationwide lockdown, but has since given way tosomething more durable.

一家欧洲品牌驻北京的员工表示:“有很多富人在高增长行业工作或持有表现良好的股票。他们从疫情中受益。”该人士补充说,高端珠宝已经“卖疯了”。

“There areplenty of rich people who have benefited from the pandemic as they work in high-growthindustries or own well-performing stocks,” said a Beijing-based employee of aEuropean brand. High-end jewellery, the person added, was “selling like crazy”.

疫情还加速了中国奢侈品市场正在发生的转变,比如电子商务的扩张,进口关税的降低,以及对由“代购”推动的灰色市场采取更加严格的管制。“代购”是一些专业买家的简称,这些人代替中国大陆人在海外购买手表、珠宝、服装和化妆品等产品。在过去,在中国销售的商品要比在欧洲或美国销售的商品贵得多,而如今,各大品牌已经开始着手缩小这种价格差异。

The pandemicalso accelerated shifts that were under way in China’s luxury market, such asthe expansion of ecommerce, lower import duties and tighter controls over thegrey market driven by daigou, professional shoppers who buy watches, jewellery,clothes and cosmetics overseas on behalf of mainland Chinese. Brands hadalready begun narrowing the price differential that had made goods sold inChina more expensive than those stocked in Europe or the US.

这一趋势也促使奢侈品牌加大在中国的投资。

Such trends haveprompted luxury brands to invest more in China.

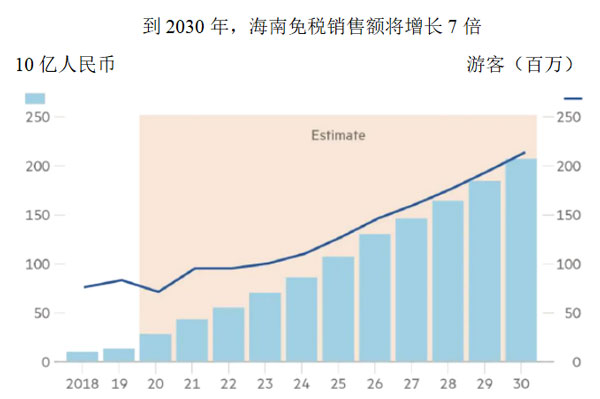

资料来源:海南海关;来自伯恩斯坦研究公司的预估和分析

杰富瑞(Jefferies)分析师的一份报告显示,只有路易威登(Louis Vuitton)、博柏利(Burberry)和古驰(Gucci)在中国最大的25个城市都开设了门店,这表明其他品牌在这方面可能需要“加把劲”。

A report fromJefferies analysts found that only Louis Vuitton, Burberry and Gucci had storesin all of China’s 25 biggest cities, suggesting that others might need toexpand their footprints.

对于这些国外品牌来说,让自己的产品在海南销售,可能是吸引更多中国消费者的一种有效方式。

Planting a flagin Hainan could be an effective way to get in front of more Chinese consumers.

日本化妆品品牌资生堂(Shiseido)计划在年底前,将其在海南的销售柜台数量增加一倍,增至60个。雅诗兰黛(Estée Lauder)也表示,消费者对其产品有强劲的需求。

Shiseido, theJapanese beauty brand, plans to double its sales counters on the island to 60by the end of the year. Estée Lauder also said it was experiencing strongdemand.

伯恩斯坦研究公司(BernsteinResearch)的数据显示,美容和化妆品占海南免税销售额的近一半,而奢侈品约占销售额的三分之一。但后者增长迅速,过去6年,在海南销售产品的奢侈品牌数量增长了80%。“我们预计还会有更多品牌加入,”伯恩斯坦的分析师写道。

Beauty andcosmetics products account for almost half of all duty free sales in Hainan,according to Bernstein Research, while luxury goods make up about one-third ofsales. But the latter are growing rapidly with the number of luxury brands onthe island up 80 per cent in the past six years. “We expect more are going tocome,” Bernstein analysts wrote.

瑞银(UBS)分析师陈欣(音)表示,海南2020年的免税销售额较上年增长一倍以上,达到300亿元人民币。她预计,2019年至2025年的年均复合增长率将达到40%。

Chen Xin, ananalyst at UBS, said Hainan’s duty free sales more than doubled in 2020 fromthe previous year to Rmb30bn, and she forecast a compound annual growth rate of40 per cent from 2019-25.

游客在海南海口一家免税店购买手提包

罗云飞(音)中国新闻社(来自Getty)

而旨在发展海南岛免税购物的政策变化,对这种增长起了进一步的巩固作用。

Furtherunderpinning this growth were policy changes intended to build up duty freeshopping on the island.

还有人担心,海南岛有被“代购”滥用的风险。

Others worrythat the island risks being abused by daigou.

“我们相信海南的发展是积极的,但我们必须保持谨慎,共同努力,以确保这里不会成为中国灰色产业的温床,”全球最大奢侈品集团路易威登的首席财务官让·雅克·吉约尼(Jean Jacques Guiony)表示。

“We believe thedevelopment of Hainan is positive but we must remain careful and work togetherto ensure that it does not become a hub for the grey market in China,” saidJean Jacques Guiony, chief financial officer of LVMH, the world’s biggestluxury group.

“如果消费者到海南旅游,来到我们的精品店,那么我们随时准备为他们服务。但如果是批量购买,然后转手卖给中介,那就不行。”

“If consumerstravel to Hainan and come to our boutiques, then we are ready to serve them.But if it is to buy in bulk and then resell to intermediaries, then no.”

尽管存在这些担忧,但路易威登集团已通过其旅游零售部门DFS在海南进行扩张。他们与深圳市国有免税商品(集团)有限公司(ShenzhenDuty Free Group)合作,在一个著名度假胜地开设了一个名为海口观澜湖(Mission Hills)的免税购物商城。免税城于今年1月开业,未来两年将继续扩大规模,达到3万多平方米的零售空间。

Despite thoseconcerns, LVMH has expanded on Hainan via DFS, its travel retail division. Thecompany has partnered with Shenzhen Duty Free Group on a duty free mall calledHaikou Mission Hills located in a popular resort. It opened in January but willbe expanded over the next two years to reach more than 30,000 sq m of retailspace.

来自上海的35岁营销主管Sharron Zhou在春节期间去海南旅游时,就遇到了拥挤的人潮,这让她望而却步,最终空手而归。“根本就找不到店员……还有人踩我的脚,”她说。不过,像观澜湖这样的免税城可能有助于缓解这种情况。

Suchdestinations could help alleviate the crowds that Sharron Zhou, a 35-year oldmarketing executive from Shanghai, ran into during her trip to Hainan over thelunar new year. She was so put off she did not buy anything. “You couldn’tfindsalespeople . . . People were stepping on my feet,” she said.

王雪乔(音)、孙宇(音)、爱丽丝·伍德豪斯(Alice Woodhouse)于上海、北京和香港补充报道

文章来源:金融时报FINANCIAL TIMES